how to work out holiday allowance: quick UK leave guide

Figuring out your holiday allowance starts with one key number: the UK statutory minimum of 5.6 weeks of paid annual leave each year. For anyone working a standard five-day week, that's a straightforward 28 days (5.6 weeks x 5 days). This is the legal floor – everything else builds from here.

Your Basic UK Holiday Entitlement Explained

Before we get into the trickier calculations for part-timers or new starters, it’s vital to get your head around the two types of holiday allowance: statutory and contractual. Knowing the difference is the first step to understanding what you're truly owed.

Statutory vs Contractual Leave

It's actually quite simple when you break it down:

- Statutory Leave is the non-negotiable legal minimum. Here in the UK, that's 5.6 weeks of paid holiday. An employer cannot legally offer you anything less than this, no matter what your role is.

- Contractual Leave is any extra holiday your company chooses to give you on top of the legal minimum. This is a perk of the job and will always be clearly laid out in your employment contract.

One of the most common questions I hear is about bank holidays. The law says a full-time employee is entitled to 28 days off, and employers can include the bank holidays within that total. However, they don't have to. For a deep dive into your rights, you can explore the fundamentals of your statutory annual leave.

For example, your contract might say you get 20 days of holiday plus the standard 8 bank holidays, which meets the 28-day statutory minimum. A more generous employer might offer 25 days plus bank holidays, giving you a total of 33 days. The key takeaway? Always check your contract.

The Full-Time Baseline

Let’s quickly look at the baseline calculation for a typical full-time employee. You just multiply the number of days you work per week by the statutory 5.6 weeks.

To make it crystal clear, here’s a quick breakdown of the statutory minimum entitlement.

UK Statutory Holiday Entitlement At A Glance

| Days Worked Per Week | Minimum Holiday Weeks | Minimum Holiday Days (5.6 x Days Worked) |

|---|---|---|

| 5 | 5.6 | 28 days |

| 4 | 5.6 | 22.4 days |

| 3 | 5.6 | 16.8 days |

| 2 | 5.6 | 11.2 days |

| 1 | 5.6 | 5.6 days |

Notice the decimals? Don't worry about those. It's common practice for employers to round these figures up to the nearest half or full day. For instance, 22.4 days often becomes 22.5 or 23 days in reality.

Once you’re comfortable with this basic calculation, you'll find it much easier to tackle entitlements for more complex working patterns, which we'll get into next.

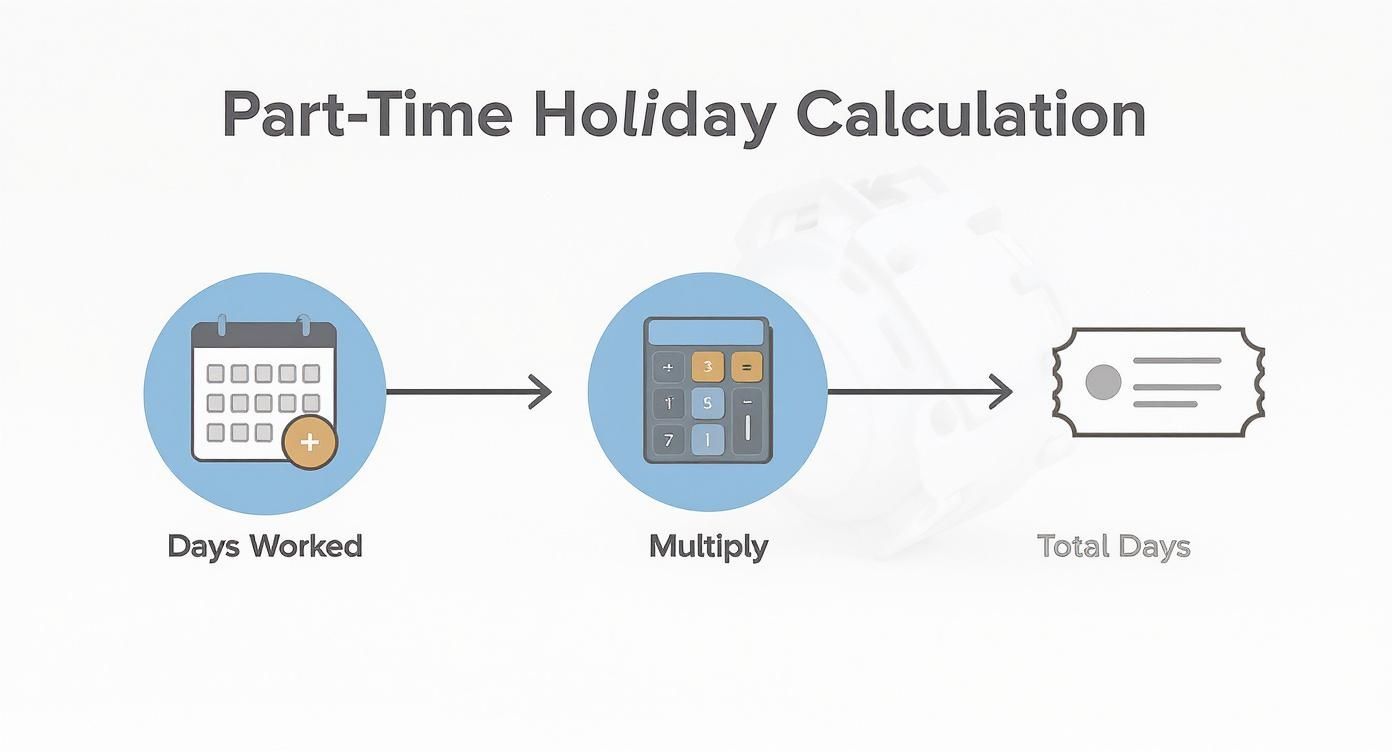

Working Out Holiday Pay for Your Part-Time Staff

Figuring out holiday allowance for part-time staff often seems more complicated than it is. The key is to remember the principle of fairness: they get the exact same 5.6 weeks of annual leave as full-time employees, just calculated on a pro-rata basis.

This just means their holiday entitlement is scaled to match the hours or days they actually work. It’s all about making sure they receive their fair share. The most straightforward approach is to calculate their entitlement based on how many days they work each week.

Calculating for Staff Who Work Set Days

Let’s take a real-world example. Imagine you have a team member, Sarah, who works a consistent three days every week. To calculate her annual leave, you simply multiply the days she works by the statutory 5.6 weeks.

- The calculation: 3 days per week × 5.6 weeks = 16.8 days of paid leave for the year.

It’s common practice—and a nice touch—for employers to round this figure up to the nearest half or full day. So, you’d likely give Sarah 17 days of annual leave. This method is perfect for anyone with a predictable weekly schedule.

What About Staff Who Work Variable Days?

But what happens when a part-time employee works a set number of hours, but on different days each week? Calculating their entitlement in 'days' just wouldn't work.

Say you have Alex, who is contracted for 20 hours a week, but his shift pattern changes. In this situation, the best approach is to calculate his holiday allowance in hours.

First, you need to know what a full-time equivalent looks like at your company. Let's assume a standard full-time week is 37.5 hours (7.5 hours over 5 days).

- A full-time employee's holiday entitlement in hours would be 28 days × 7.5 hours/day = 210 hours.

- Alex’s total annual working hours are 20 hours/week × 52 weeks = 1,040 hours.

- A full-time employee's total annual working hours are 37.5 hours/week × 52 weeks = 1,950 hours.

Now we have all the numbers we need. The most accurate way to find Alex's entitlement is to figure out what percentage of a full-time role he works and then apply that percentage to the full-time holiday allowance in hours. It sounds like a lot of steps, but the maths is straightforward.

From here, you simply calculate the percentage and apply it to the total holiday hours. For a complete walkthrough of this method, have a look at our simple UK guide on how to calculate pro-rata holidays. Following this process ensures that every single employee gets the correct amount of paid time off, no matter their working pattern.

Handling Leave for Irregular and Zero-Hours Workers

Let's be honest, figuring out holiday allowance for staff on zero-hours contracts or with constantly changing schedules can feel like a real puzzle. You can't just use a simple pro-rata calculation like you would for a part-timer with fixed days. For these team members, the only fair and legally sound way forward is a percentage-based approach.

The magic number here is 12.07%. This figure is the standard for calculating holiday entitlement based on the hours someone has actually worked. It's not just pulled out of thin air; it ensures that everyone, from hospitality staff to gig economy workers, earns leave in direct proportion to their contribution.

Why The 12.07% Method Works

So, where does 12.07% come from? UK law gives workers 5.6 weeks of paid leave. The working year, once you subtract that holiday, is 46.4 weeks (52 - 5.6).

The calculation is simply the holiday weeks divided by the working weeks: 5.6 ÷ 46.4 = 12.07%. This method ensures that holiday pay is a fair reflection of the hours someone puts in.

Let’s see it in action. Say you have a zero-hours worker, Ben, who clocked 80 hours last month.

- To work out his accrued leave, you'd do: 80 hours × 12.07% = 9.656 hours of annual leave earned.

It's that straightforward. For every hour Ben works, he builds up just over seven minutes of paid time off. If you need a more detailed guide, it's worth reading up on understanding holiday entitlement on a zero-hour contract.

The principle is the same whether you're calculating based on days or hours, as this quick visual shows.

The core formula is what matters, and it's remarkably consistent once you get the hang of it.

A Quick Word on Rolled-Up Holiday Pay

You might have come across the concept of ‘rolled-up’ holiday pay. This is when an employer simply adds the extra 12.07% to an employee's hourly rate, rather than paying it when they take a holiday. Be very careful here, as this practice is not legally compliant.

The whole point of holiday pay is that it's paid for time when an employee is actually on leave. Lumping it into their regular wages can discourage people from taking the rest they're entitled to, which goes against the spirit of the Working Time Regulations. Holiday pay should always be a separate payment made when the annual leave is taken.

Handling Holiday Pay When People Join or Leave

Things get a bit trickier with holiday calculations when someone joins or leaves your company part-way through the leave year. It wouldn't be fair to give them a full year's allowance, so instead, you work it out on a pro-rata basis. This just means they get a fair portion of leave for the time they’ve actually been on the payroll.

The most common way to handle this is by calculating leave on a monthly accrual basis. Simply put, an employee "earns" one-twelfth of their total annual holiday for each full month they work.

Calculating for a New Starter

Let's walk through a real-world example. Imagine a new full-timer, David, starts on the 1st of September. He’s entitled to the statutory 28 days of annual leave, and your company's holiday year runs from January to December.

Here's how you'd figure out his allowance for the rest of the year:

- First, find his monthly accrual rate: 28 days ÷ 12 months = 2.33 days earned per month.

- Next, count the months he'll actually work: September, October, November, and December. That’s four full months.

- Finally, multiply the two: 4 months × 2.33 days = 9.32 days of holiday.

In practice, most employers would round that figure up to the nearest half-day. So, David would have 9.5 days of holiday to use before the year is out.

Finalising Holiday Pay When Someone Leaves

When an employee hands in their notice, you need to run a similar calculation to make sure their final payslip is spot on. This process will tell you if you owe them for any leave they haven't taken, or, in some cases, if they've used more holiday than they'd actually earned.

It's a legal requirement to pay an employee for any statutory holiday they've accrued but not taken by their last day. This is often called 'payment in lieu of holiday' and you must include it in their final pay.

On the flip side, what if someone has taken more holiday than they’ve earned? You might be able to deduct the value of that extra time from their final pay, but only if you have a specific clause in their employment contract that allows for it.

Without that clause written down and agreed to, you can't make the deduction. This is why it’s so important to have it clearly stated in your company handbook from day one—it prevents any nasty surprises or disputes when a team member moves on.

Common Holiday Allowance Mistakes to Avoid

Getting the numbers right is a huge part of managing leave, but some of the biggest headaches come from policy grey areas. I've seen it time and again—a few common missteps can easily lead to confusion, disputes, and unhappy team members. Knowing what to watch for is just as important as the initial calculation.

One of the most frequent errors I see is businesses not having a crystal-clear, written holiday policy. Think of this document as your first line of defence against misunderstandings. It should explicitly cover everything from booking leave during a notice period to the rules on carrying over unused days.

Overlooking Key Policy Details

Without a formal policy, you’re basically relying on unwritten rules, and that rarely works out well. A strong policy needs to be unambiguous and should clearly define:

- Carrying Over Leave: Can employees carry over unused days into the next leave year? If they can, how many days is the limit, and is there a deadline for them to be used by?

- Leave During Sickness: What happens if someone falls ill just before or during their planned holiday? It's crucial to know that they have the right to convert that time to sick leave and reschedule their holiday.

- Booking During Notice Periods: Can a departing employee use their remaining holiday during their notice period? Your policy can specify if this is allowed, restricted, or simply requires manager approval.

A common mistake is assuming employees must take holidays when sick. Legally, an employee can choose to take sick leave instead and save their annual leave for when they’ve recovered. This protects their right to a proper rest.

Interestingly, despite these entitlements, it seems many employees aren't taking their full allowance anyway. Recent UK data shows that from 2020 to 2023, the average number of leave days taken per employee actually dropped by nearly 12%. You can dig deeper into the state of annual leave in the UK and see why clear policies are so vital for encouraging people to take a proper break.

Got More Questions About Holiday Pay?

Even once you've got the hang of the calculations, real-life situations can throw a spanner in the works. Let's tackle some of the common questions that pop up, so you can handle them with confidence. Think of this as your go-to guide for those tricky, everyday scenarios.

Can My Employer Tell Me When to Take My Holiday?

In short, yes. Your employer can dictate when you take your annual leave. This often happens in industries with set shutdown periods, like manufacturing firms that close over Christmas.

But they can't just drop it on you at the last minute. The rule of thumb is that they have to give you notice that's at least twice as long as the leave they want you to take. So, if they need you to take a week off, they must tell you at least two weeks beforehand.

What Happens to My Holiday Allowance When I'm on Maternity Leave?

Your holiday entitlement, both statutory and contractual, keeps building up as normal for the entire time you're on maternity leave. It accrues just as if you were still in the office.

A lot of new parents use this banked holiday to add a bit more time onto the beginning or end of their maternity leave, giving them more precious time with their baby. It’s always a good idea to chat this through with your employer before your leave starts so everyone is on the same page.

Do I Get Paid Extra for Working a Bank Holiday?

There’s no automatic legal right to extra pay for working on a bank holiday in the UK. Whether you get time-and-a-half or double pay is entirely down to what’s written in your employment contract.

If your contract is silent on the matter, your employer only needs to pay your standard rate. And if that bank holiday is part of your statutory 5.6 weeks' leave, you must be given that day off at another time (known as a day off in lieu).

It's a common myth that everyone gets bank holidays off as paid leave. The reality, especially in sectors like retail and hospitality that are open year-round, is that your contract is king.

What if I Get Sick While I'm on Holiday?

If you fall ill just before or during a pre-booked holiday, you can take that time as sick leave instead. Just make sure you follow your company’s usual sickness reporting procedure to make it official.

You can then rearrange the holiday you missed for a later date. This right still applies even if it means carrying that leave over into the next year. Your employer can’t force you to take annual leave when you're unwell and entitled to sick pay.

Trying to keep track of all these nuances by hand is a real headache. A tool like Annual Leave Tracker handles everything from accruals during maternity leave to managing days in lieu, making sure your records are always spot-on. You can see how it works on their website.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.