How to Calculate Pro Rata Holidays A Simple UK Guide

Working out pro rata holidays is actually quite straightforward. At its core, it's just about making sure your holiday allowance is proportional to the time you actually work. This is the key to ensuring part-time staff get a fair deal compared to their full-time colleagues.

Understanding Your Pro Rata Holiday Entitlement

Let's cut through the jargon. "Pro rata" is a Latin term that simply means "in proportion." When we talk about annual leave, it means an employee's holiday entitlement is directly linked to the number of days or hours they put in. It's a system designed from the ground up to be fair for everyone, no matter their work pattern.

This principle is essential for any UK business that has people on its team like:

- Part-time staff working a set number of days each week.

- Term-time only employees, which you see a lot in schools and colleges.

- Anyone on a zero-hour or irregular-hours contract.

The whole point is to avoid a scenario where someone working two days a week gets the same paid holiday as a full-time employee—or, just as importantly, gets treated unfairly. It’s all about creating an equitable system that’s firmly rooted in UK employment law.

The Legal Framework

The rules for this are laid out in the Working Time Regulations 1998. This piece of legislation sets the statutory minimum holiday for a full-time worker at 5.6 weeks per year. This allowance can, and often does, include bank holidays.

For someone on a standard five-day week, that 5.6 weeks works out to be 28 days.

For part-time staff, that 5.6-week figure is the magic number. The standard way to calculate their entitlement is to multiply the number of days they work each week by 5.6. So, for an employee who works three days a week, the calculation is 3 × 5.6 = 16.8 days of holiday per year. You can find more details in this helpful guide to UK statutory holiday allowance.

The crucial thing to remember is that fairness isn't just a suggestion; it's the law. The Part-Time Workers (Prevention of Less Favourable Treatment) Regulations 2000 explicitly protect part-time staff. This makes getting pro rata calculations right a matter of legal compliance, not just good HR practice.

Once you get your head around this foundation, you can tackle any holiday calculation with confidence, whether you're a manager sorting out the payroll or an employee just checking your own allowance is correct.

Calculating Holidays for Fixed Part-Time Schedules

When it comes to pro rata holidays, the most common situation you'll face is for employees who work a fixed number of days each week. The good news? This is also the most straightforward calculation to get right. The principle is simple: their holiday entitlement is a direct proportion of the hours or days they work.

Let’s put this into practice. The statutory minimum holiday entitlement here in the UK is 5.6 weeks. For a standard full-time employee working five days a week, that’s 28 days (5 days × 5.6 weeks). To figure out the allowance for a part-timer, you simply multiply the number of days they work per week by 5.6.

The Standard Calculation Method

Say you have a team member, Sarah, who works a consistent three days every week. To calculate her annual leave, the maths looks like this:

- Calculation: 3 working days × 5.6 weeks = 16.8 days of paid holiday per year.

It really is that simple. If another employee, David, works two days a week, his calculation would be 2 days × 5.6 weeks, which gives him 11.2 days of annual leave. This approach ensures everyone is treated fairly, regardless of their working pattern. Keeping on top of these different allowances manually can become a real headache, which is why many businesses find that an annual leave tracker quickly pays for itself.

The infographic below illustrates a similar formula, this time for calculating leave when someone joins part-way through the year.

This formula is a great way to visualise how entitlement is built up over time based on the days an employee actually works.

Handling Fractions and Rounding Up

You've probably noticed that these calculations often end up with a fraction of a day, like 16.8 or 11.2. This is where a lot of people get tripped up. What do you do with that decimal point? Thankfully, UK employment law is very clear on this.

You must always round up a holiday entitlement to the next half or full day. You are not legally permitted to round down.

So, for Sarah, her 16.8 days must be rounded up to 17 full days of holiday. For David, his 11.2 days should be rounded up to 11.5 days. It might seem like a small detail, but getting this wrong is a common pitfall that can lead to compliance issues and, understandably, unhappy team members.

Pro Rata Holiday Allowance for Part-Time Work Patterns

To make it even clearer, here’s a quick-reference table showing the statutory minimum holiday allowance for employees working fewer than five days a week.

| Days Worked Per Week | Calculation (Days x 5.6 weeks) | Annual Holiday Entitlement (Days) |

|---|---|---|

| 1 Day | 1 x 5.6 | 5.6 (rounded up to 6 days) |

| 2 Days | 2 x 5.6 | 11.2 (rounded up to 11.5 days) |

| 3 Days | 3 x 5.6 | 16.8 (rounded up to 17 days) |

| 4 Days | 4 x 5.6 | 22.4 (rounded up to 22.5 days) |

As you can see, the calculation is consistent, and the final entitlement is always rounded up to the nearest half or full day to ensure you remain compliant with UK regulations.

How to Handle Holiday Pay for Irregular Hours and Zero-Hour Contracts

Figuring out holiday pay for staff on zero-hour contracts or those who work irregular patterns can feel like a headache. You can’t just multiply a set number of days by the standard 5.6 weeks because their working hours are all over the place.

Figuring out holiday pay for staff on zero-hour contracts or those who work irregular patterns can feel like a headache. You can’t just multiply a set number of days by the standard 5.6 weeks because their working hours are all over the place.

The law is clear, though: these workers are absolutely entitled to paid leave. The challenge is working out what a "week's pay" actually means for them.

The key is to use the 52-week reference period. Essentially, you need to calculate their average weekly pay over the last 52 weeks where they actually earned money. If you hit a week where they didn't work and earned nothing, you skip it and go back further until you've gathered 52 paid weeks. Don't worry, there's a cap – you only need to look back a maximum of 104 weeks.

The 52-Week Pay Reference Period In Practice

To get this right, you first need to add up the employee's total gross pay across those 52 paid weeks. Once you have that figure, just divide it by 52.

The result is their average weekly pay, and that’s exactly what you need to pay them for each week of holiday they take.

Let’s run through a quick example. Say a casual worker earned a total of £9,100 over the last 52 weeks they were paid for.

The maths looks like this:

- £9,100 (total pay) ÷ 52 (weeks) = £175

Simple. For every week of holiday this person takes, their pay packet should be £175. This approach makes sure their holiday pay genuinely reflects their typical, often fluctuating, earnings.

A Costly Mistake: The Outdated 12.07% Method

For a long time, many businesses took a shortcut, calculating holiday entitlement as 12.07% of hours worked. While the percentage was based on the statutory 5.6 weeks of holiday, it's now a major compliance risk.

This method was effectively banned following the landmark Supreme Court ruling in Brazel v The Harpur Trust. The court confirmed that all workers are entitled to 5.6 weeks of holiday, paid based on their average earnings over the 52-week reference period—not as a percentage of their hours.

Clinging to the 12.07% method can easily lead to underpaying your staff, especially seasonal or term-time workers. That mistake could land you in front of an employment tribunal, facing a hefty bill. The legal wrangles surrounding these cases, which you can read more about in this guide on the complexities of holiday pay on CIPP.org.uk, show just how vital it is to get your calculations right.

My advice? Stick to the 52-week reference period. It’s the only way to be certain you’re paying your team correctly and staying on the right side of the law.

It’s not often that a new team member starts on the first day of your holiday year, or a leaver’s last day falls neatly on the last. That's why getting to grips with pro rata holiday calculations is such a crucial, day-to-day skill for anyone managing a team. The core idea is simple: employees earn their holiday leave as they work through the year.

Most UK businesses follow a standard practice where holiday entitlement builds up each month, accruing at a rate of 1/12th of the total annual allowance. So, for a full-time employee who gets the statutory minimum of 28 days a year, they bank roughly 2.33 days for every full month they’re with you. When someone leaves part-way through the year, you'll need to work out exactly what they've earned up to their final day. You can find a deeper dive into calculating holiday pay for leavers on Parim.co.uk.

Calculating Entitlement for Leavers

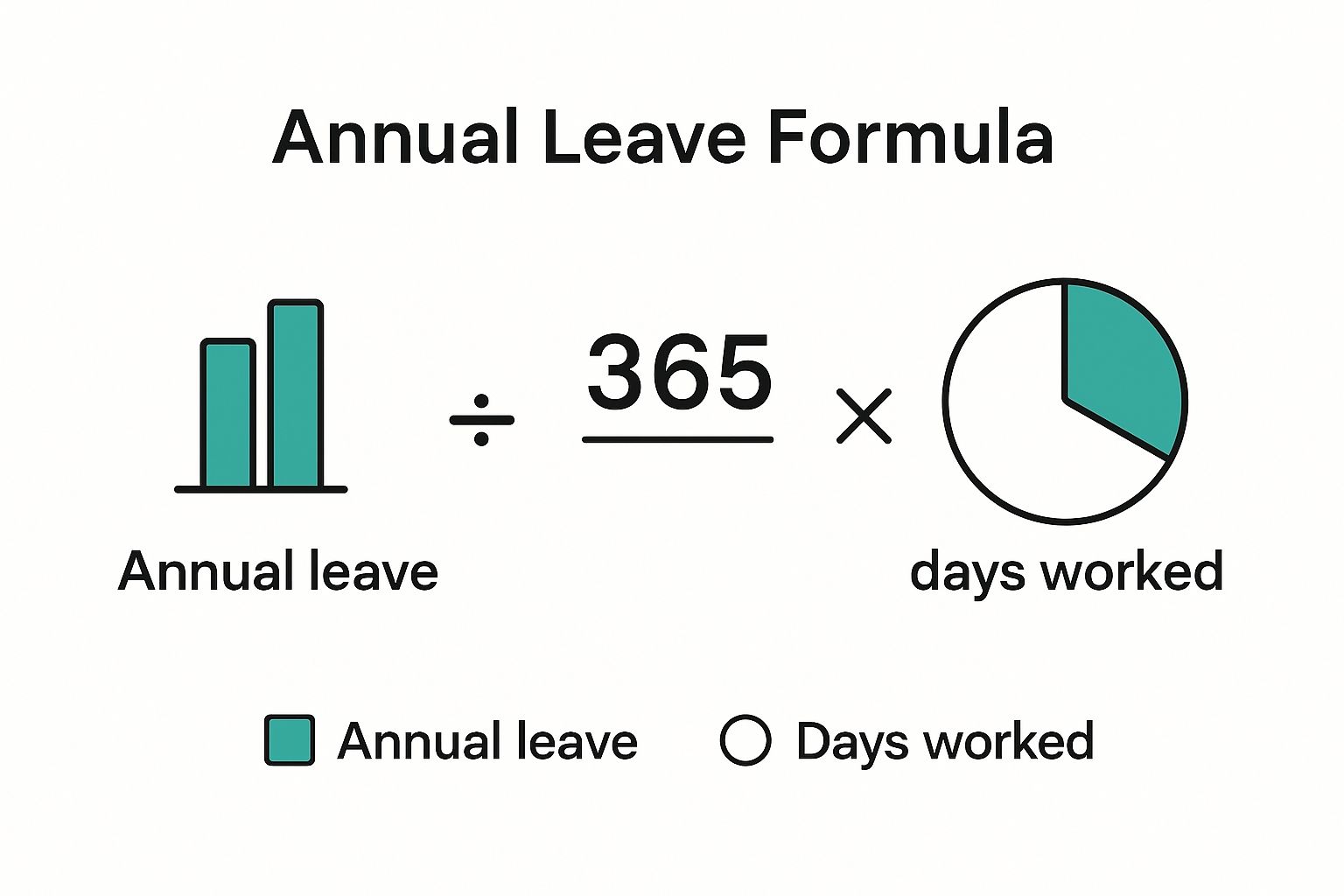

Figuring out the exact leave someone is owed when they resign isn't as complicated as it sounds. The process involves a simple formula: you work out the fraction of the year they've been on the payroll and multiply that by their full annual holiday entitlement.

Let's walk through a common scenario. Say your company's leave year runs from January to December. A full-time employee with a 28-day annual allowance hands in their notice and their last day is at the end of April.

Here's how you'd break it down:

- First, find the proportion of the year they worked: They completed 4 full months out of 12. So, the calculation is 4 ÷ 12 = 0.333.

- Next, calculate their accrued holiday: You multiply their full entitlement by that fraction: 28 days × (4 ÷ 12) = 9.33 days.

In practice, you would round this figure up to the nearest half-day, which gives you 9.5 days. If they’ve taken less holiday than this, you’ll need to pay them for the days they haven't used in their final payslip.

One crucial tip for employers: if an employee has taken more holiday than they've accrued when they leave, you can only legally deduct the difference from their final pay if there's a specific, clearly worded clause in their employment contract allowing you to do so. If that clause isn't there, you may have to absorb the cost.

This same logic for accrual applies to new starters, too. It’s the fairest way to ensure they start building up their well-earned time off from day one.

Common Pro Rata Mistakes and How to Avoid Them

Even the most careful managers can trip up when calculating pro rata holidays. These small missteps, though often unintentional, can cause real friction with your team and potentially land you in legal trouble. Getting to grips with the common pitfalls is the best way to keep your holiday calculations fair, accurate, and compliant.

One of the most frequent errors I see involves bank holidays for part-time staff. There's a common misconception that if a bank holiday falls on a day a part-timer doesn't work, it's just bad luck. That approach is a recipe for trouble and can easily lead to claims of unfair treatment.

Another huge one is clinging to the old 12.07% shortcut for staff on irregular hours. This method was widely used, but it’s now outdated and legally unsafe after some significant court rulings. If you’re still using it, you are almost certainly underpaying your people and leaving your business wide open to backdated claims.

Keeping Your Calculations Compliant

The secret to avoiding these mistakes isn't just about getting the maths right. It's about having solid, clear policies and a system you can rely on. This builds a transparent process that everyone in your team can understand and trust.

Here are a few practical tips to help you stay on the straight and narrow:

- Handle Bank Holidays Fairly: Your part-time employees are entitled to a pro-rata share of all bank holidays. It doesn't matter if the holiday lands on their day off. You'll need to compensate them, perhaps with a day off in lieu, to ensure they aren't losing out.

- Move on From the 12.07% Method: For anyone on a casual or zero-hours contract, the only legally sound way to calculate their holiday pay is by using the 52-week reference period to find their average pay. It's more work, but it’s the law.

- Keep Meticulous Records: Always, always document how you’ve calculated someone’s holiday entitlement. If an employee ever questions it, or a dispute arises down the line, these records will be your saving grace.

A crystal-clear, written holiday policy isn't just nice to have—it's essential. It should spell out exactly how you handle accrual for new starters, final pay for leavers, and your rules on carrying over unused days. When it comes to holiday pay, ambiguity is your worst enemy.

Ultimately, a good system is your best defence against human error. This is where dedicated software can be a game-changer, automating the complex calculations, saving you a headache, and significantly cutting down your risk.

For more deep dives into managing leave effectively, check out the guides on the Annual Leave Tracker blog.

Answering Your Pro Rata Holiday Questions

Even when you've got the formulas nailed down, real-life situations can throw a spanner in the works. Let's walk through some of the most common questions I see crop up when calculating pro rata holidays.

These are the practical, day-to-day issues that can easily trip employers up if you’re not prepared.

How Do Bank Holidays Affect Part-Time Staff?

This is a classic point of confusion, but the guiding principle is simple: fairness. If a bank holiday falls on a day your part-time employee normally works, they should absolutely get that day off as paid leave.

But what if it falls on their non-working day? They aren't automatically entitled to an extra day off in lieu. The crucial part is ensuring they receive their full pro rata entitlement of 5.6 weeks holiday over the year, which can include bank holidays.

A common and fair approach is to give them a pro-rata allocation of bank holidays at the start of the year. They can then use this allowance to "book" the bank holidays that fall on their working days. This method ensures they aren't unfairly disadvantaged compared to their full-time colleagues.

What Happens if an Employee Changes Their Hours Mid-Year?

When an employee’s working hours change part-way through the year, you need to recalculate their holiday entitlement. You can't just apply the new pattern to the whole year, as that wouldn’t be accurate for the time they’ve already worked.

It’s a two-step process:

- First, calculate the holiday they accrued based on their old working hours for the portion of the year already passed.

- Then, calculate the holiday they will accrue on their new hours for the rest of the year.

Add these two figures together, and you'll have their total, accurate holiday entitlement for the year. It's vital to communicate this clearly to the employee to avoid any confusion.

Remember, the goal is always proportionality. Their final leave allowance for the year must accurately reflect the different work patterns they had. Manually tracking this can be a real headache, which is why many businesses explore different leave tracker pricing options to automate the process and eliminate errors.

Should Overtime Be Included in Holiday Pay Calculations?

In many cases, yes. This is a big one that many employers get wrong. For the first four weeks of statutory annual leave (often called 'Euro leave'), holiday pay must be based on a worker's 'normal remuneration'.

This doesn't just mean their basic salary. It also includes regular payments like commission and, importantly, consistently worked overtime.

For the additional 1.6 weeks of UK statutory leave, holiday pay can typically be based on their basic salary alone, unless their employment contract says otherwise. Forgetting to include regular overtime in holiday pay calculations is a common pitfall that can easily lead to underpayment claims down the line.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.