How to Calculate Annual Leave Entitlement: UK Guide

Figuring out annual leave entitlement doesn't have to be complicated. The basic formula is simple: multiply the number of days you work each week by 5.6. That’s the statutory minimum in weeks. For most people working a standard five-day week, this works out to 28 days of paid holiday a year. This figure often includes bank holidays, but we'll get to that.

Understanding Your Basic Annual Leave Rights

Before you start crunching numbers, it’s worth getting a firm grip on your fundamental holiday rights in the UK. The law is there to make sure nearly every worker gets a set amount of paid time off. It's a legal guarantee for a proper break from work.

A key point to remember is that your holiday entitlement starts building up—or 'accruing'—from day one of your job. You don't need to pass a probation period; that holiday pot starts filling from the moment you start.

What Is Statutory Annual Leave?

Statutory annual leave is simply the legal minimum holiday an employer has to give you. In the UK, that’s 5.6 weeks a year. This applies across the board, whether you're full-time, part-time, or an agency worker.

If you work a typical five-day week, that translates directly to 28 days of paid leave (5 days × 5.6 weeks). It's important to see this as the legal floor, not a ceiling. Many companies offer more generous holiday packages to attract and retain staff, so always check your contract.

The concept of accrual is crucial here. Your holiday allowance is earned as you go. With a standard 28-day entitlement, you're earning roughly 2.33 days for every full month you work.

To give you a clear, at-a-glance view, here’s a quick summary of the statutory minimum for a full-time employee.

Quick Guide to Statutory Minimum Annual Leave

| Entitlement Type | Minimum Amount |

|---|---|

| Annual Leave (Weeks) | 5.6 weeks |

| Annual Leave (Days) | 28 days |

This table lays out the bare minimum required by law. Your own entitlement could be higher depending on your employer's policy.

The Role of Bank Holidays

Bank holidays are a common source of confusion. The 28-day statutory minimum for a full-time worker can include the 8 public bank holidays we get in England and Wales. Employers have some leeway here. They can either roll the bank holidays into your 28-day allowance or give them to you as extra paid days off.

This is why checking your employment contract is absolutely essential. It will spell out exactly how your company handles bank holidays. Using a proper system can clear up any confusion, and you can see how to manage this by exploring a dedicated annual leave tracker.

Calculating Leave for Full-Time Employees

Thankfully, when it comes to your full-time staff working a typical five-day week, figuring out their holiday allowance is usually pretty straightforward. It's the most common scenario, and the calculation provides a clear baseline to ensure you're meeting your legal duties.

The basic formula is simply the statutory minimum of 5.6 weeks multiplied by the number of days they work. For a standard full-time employee, this works out as 5.6 weeks x 5 days = 28 days of paid annual leave.

But just knowing the total for the year isn't always enough. You also need to understand how that entitlement builds up over time, especially for new starters.

How Holiday Entitlement Accrues Monthly

Holiday leave starts accruing from day one of employment. For a full-timer getting the standard 28 days, this builds up at a rate of roughly 2.33 days each month (which is just 28 days divided by 12 months). This is essential for working out the pro-rata allowance for someone who joins part-way through your company's holiday year.

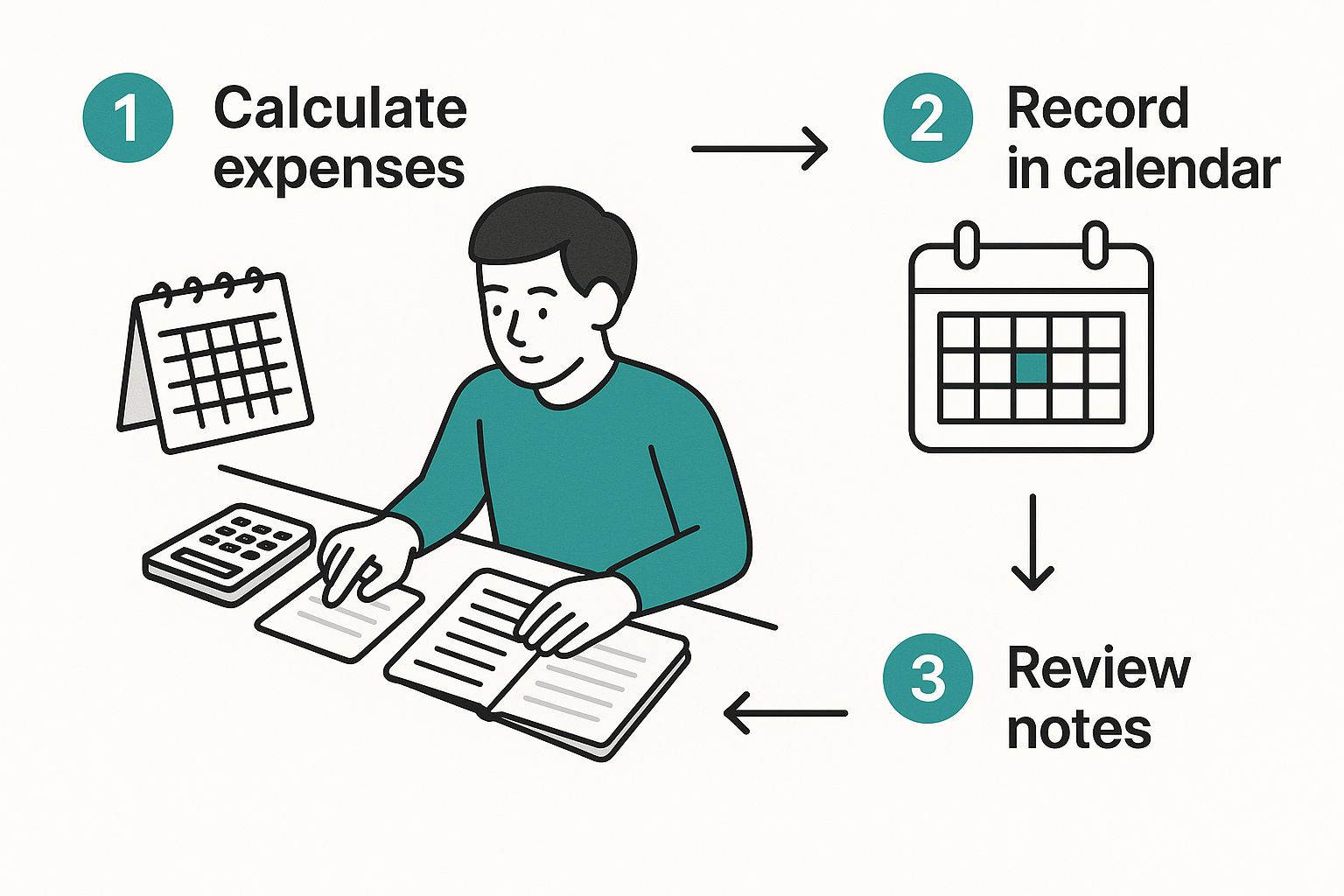

Let’s run through a quick, real-world example:

- Scenario: Your new hire, Sarah, starts on the 1st of July. Your company's leave year runs from January to December.

- Calculation: This means Sarah will be with you for six full months of the current leave year (July through to December).

- Entitlement: Her holiday for the remainder of the year is 6 months x 2.33 days = 13.98 days. As a best practice, you should always round this figure up to the nearest half or full day, giving Sarah 14 days to take before the year is out.

Keep in mind, the 28 days is the legal floor, not the ceiling. If your company offers a more generous package, say 33 days (which might include bank holidays), you'll need to base your calculations on that figure instead. In that case, the accrual would be 33 ÷ 12 = 2.75 days per month. Always double-check the employee's contract to confirm their specific allowance.

Working Out Pro-Rata Leave for Part-Time Staff

Calculating holiday for part-time staff can feel like a headache, but the core principle is actually quite straightforward. They get the same holiday allowance as their full-time colleagues, just scaled down—or pro-rata—to reflect the days they work.

Getting this right is all about fairness and, of course, staying on the right side of the law. The simplest way to do this is by starting with the statutory minimum of 5.6 weeks of paid holiday.

Calculating for Consistent Part-Time Days

Let's start with a common scenario. You have a team member, David, who works a fixed three days every single week. The calculation to figure out his holiday entitlement is nice and simple.

You just multiply the statutory weeks by the number of days he works:

- Calculation: 5.6 weeks × 3 days per week = 16.8 days of annual leave.

This gives David the correct, proportional equivalent of a full-timer's 28 days. He's getting the same amount of time off relative to his working pattern.

This visual guide breaks down how that calculation works for different part-time schedules.

As you can see, it's a consistent formula: statutory weeks multiplied by days worked. Simple, but effective.

One of the first questions I always get asked is what to do with the decimal. In David's case, it's the .8 in his 16.8 days. Best practice—and what the law requires—is that you must always round up to the next half or full day. You can never round down. So, David’s official entitlement for the year becomes 17 days.

For Staff with Varying Days but Consistent Hours

But what happens when things aren't so neat? Imagine an employee works a set number of hours, say 20 hours a week, but their workdays change. One week they might do three longer days, the next it could be four shorter ones.

In these situations, it's much easier and more accurate to calculate their holiday entitlement in hours instead of days.

Let’s put it in context. A full-time employee on 40 hours a week gets 224 hours of leave (40 hours × 5.6 weeks). So, for your part-timer working 20 hours a week, their entitlement would simply be 112 hours of holiday (20 hours × 5.6 weeks).

Tracking leave in hours gives you the precision you need for those less-standard schedules. Managing these kinds of variations can be tricky, but we share more practical tips for handling different working patterns over on our company blog.

Calculating Holiday for Irregular and Zero-Hours Contracts

Figuring out holiday entitlement for staff on irregular or zero-hours contracts can feel like a headache. But it all comes down to a simple, fair principle: holiday is earned as they work. Instead of getting a fixed number of days upfront, their leave allowance grows proportionally with the hours they put in.

This accrual method ensures that a casual worker who does a few shifts a month doesn't get the same paid time off as a full-time employee. It keeps things fair and legally compliant.

The 12.07% Accrual Method Explained

The key to this whole process is one number: 12.07%.

This isn't just pulled out of thin air. It’s calculated directly from the statutory holiday calendar. A standard working year is 52 weeks, but full-time staff get 5.6 weeks of paid leave. This means they are only actually working for 46.4 weeks of the year (52 weeks - 5.6 weeks).

So, if you divide the holiday weeks by the working weeks, you get the magic percentage: 5.6 ÷ 46.4 = 0.1207, which we round to 12.07%.

You then apply this percentage to the hours an employee has worked in a given pay period. It's the standard, government-accepted way to ensure casual and zero-hours workers accrue leave fairly from their very first day on the job. If you want to dive deeper, it's worth exploring the full legal foundations of how UK annual leave works.

Let's look at a quick, real-world scenario to see how this plays out.

Example Calculation

Let's say Tom is on a zero-hours contract and works 50 hours in a month. To figure out how much holiday time he’s earned, you just multiply his hours by the accrual rate:

- 50 hours worked × 12.07% = 6.035 hours of holiday accrued

Simple as that. For that month's work, Tom has banked just over six hours of paid leave.

Calculating Holiday Pay with a 52-Week Reference Period

Okay, so you know how much holiday time they've earned. But what do you actually pay them for that time off? This is crucial for workers whose pay and hours can vary wildly from one week to the next.

You can't just use their standard hourly rate if it fluctuates. Instead, the law requires you to calculate their average hourly rate based on their earnings over the previous 52 paid weeks.

Here’s how you break that down:

- First, add up the employee's total pay over the last 52 weeks in which they actually earned something. (If they had a week with no work, you skip it and go back another week).

- Next, total the number of hours they worked during that same 52-week period.

- Finally, divide the total pay by the total hours. This gives you their average hourly pay rate.

This method ensures their holiday pay is a true reflection of their typical earnings, providing fair compensation even when their work schedule is all over the place.

Managing Unused Annual Leave and Company Policies

It’s a familiar story in many workplaces. Pressing projects and tight deadlines often push taking time off to the bottom of the to-do list. Before you know it, employees are hesitant to book a break, even when they’re clearly in need of one.

This cycle is a problem. When people don't use their annual leave, it's not just a logistical headache for managers; it directly impacts wellbeing and engagement across the team.

The numbers really paint a picture here. In 2024, data from over 250,000 UK employees showed the average worker finished the year with five unused holiday days. That's a full working week of rest and recuperation just left on the table. You can find more insights in these annual leave statistics in the UK.

Then there's the year-end scramble, made even more confusing by company rules around carrying over days or "use it or lose it" policies.

Let’s clear up a few common points for both employers and their teams:

- Carryover Limits: Most companies that allow carryover will cap it at around three to five days, and it usually requires a manager's approval.

- Leaving a Job: When someone leaves the company, any holiday they've accrued but not taken is typically paid out in their final salary.

- "Use It or Lose It": Strict policies are common, but they can't override an employee's right to their statutory minimum leave.

A bit of planning goes a long way. To get ahead of these issues and keep things simple, it's worth exploring tools with good absence management features from Annual Leave Tracker.

Carry Over Regulations

So, what does the law say? Workers are legally entitled to carry over up to 1.8 weeks of their statutory leave if they couldn't take it due to things like long-term sickness or family-related leave. Anything beyond that is entirely up to the employer.

This is why having a crystal-clear carry-over policy is non-negotiable. It should outline exactly how many days can be rolled over and the deadline for using them. Publishing these rules at the start of the holiday year prevents any nasty surprises later on.

Think of a clear leave policy not as a rulebook, but as an investment in your team's wellbeing and your own legal compliance.

Handling Unused Leave Pay

If your company doesn't allow contractual carryover, the classic "use it or lose it" rule kicks in—but only within legal limits. Any remaining statutory holiday that an employee hasn’t taken when they resign must be paid out.

The best managers don't wait for the year-end panic. They actively encourage their teams to book time off well in advance. Simple tools like automated reminders and easy-to-use team calendars can make all the difference, preventing a pile-up of unused days and fostering a much healthier, rested workforce.

Even when you've got the formulas down, real-life situations can throw a spanner in the works. What if someone’s on long-term sick leave, or wants to use up their holiday after they’ve resigned? Let's walk through some of the trickiest questions I see crop up all the time.

What About Sick Leave and Maternity Leave?

People often ask if an employee can take annual leave while they’re off sick. The answer is yes, they can. An employee might choose to do this if they’ve run out of company sick pay or aren’t eligible for Statutory Sick Pay, as it ensures they still get paid.

Maternity leave is another big one. It's a common misconception that holiday accrual stops, but that’s not the case at all.

Your team members continue to build up their full holiday entitlement while on any kind of statutory family leave, including maternity, paternity, adoption, or shared parental leave. So, if someone takes a full year for maternity leave, they’ll come back with a full year's worth of holiday to take.

Taking Holiday During a Notice Period

And what about when someone hands in their notice? As an employer, you can actually require an employee to use their remaining holiday during their notice period, which is often useful for handover periods.

On the flip side, an employee can ask to take their holiday, but you don't have to agree if it's going to cause operational problems for the business. It’s a bit of a balancing act.

Final Pay and Untaken Leave

When an employee leaves the company, for whatever reason, you have to sort out their final holiday pay. This is a common point of confusion but the rules are quite clear.

- You must pay for any holiday they’ve accrued but haven't used.

- This payment is worked out using their normal rate of pay and should be included in their final payslip.

- Crucially, this is a legal requirement. It applies even if the employee was dismissed for gross misconduct.

Juggling these rules for every employee, especially in a growing team, can quickly become a headache. A tool like Annual Leave Tracker handles all the complex calculations for you, from accruals during leave to final payments, keeping you compliant and your records straight. Learn how Annual Leave Tracker can streamline your absence management.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.