A Guide to Calculating Pro Rata Holiday Entitlement

Working out pro rata holiday entitlement is just a way of figuring out the fair, proportional amount of paid time off for anyone who isn't on a standard full-time contract. It's a must-do for UK businesses, ensuring that your part-time, temporary, or variable-hour staff get what they're legally entitled to. The whole calculation hinges on the statutory minimum of 5.6 weeks of paid leave.

Why Pro Rata Calculations Are Essential

Getting your head around 'pro rata' is fundamental for any UK employer. It's the method you use to fairly calculate paid holiday for anyone not working a typical full-time week. This isn't just about being a good employer; it’s a legal requirement under the UK's Working Time Regulations. The law is clear: you can't treat part-time workers less favourably than their full-time colleagues.

This calculation is absolutely critical for a huge part of today's workforce, including:

- Part-time employees who work fixed days or hours.

- Temporary staff joining you for a specific project or a set period.

- Variable-hour or zero-hour contract workers whose schedules can change from one week to the next.

For these team members, a standard holiday allowance just doesn't fit. The pro rata approach makes sure their entitlement is directly proportional to the time they actually work.

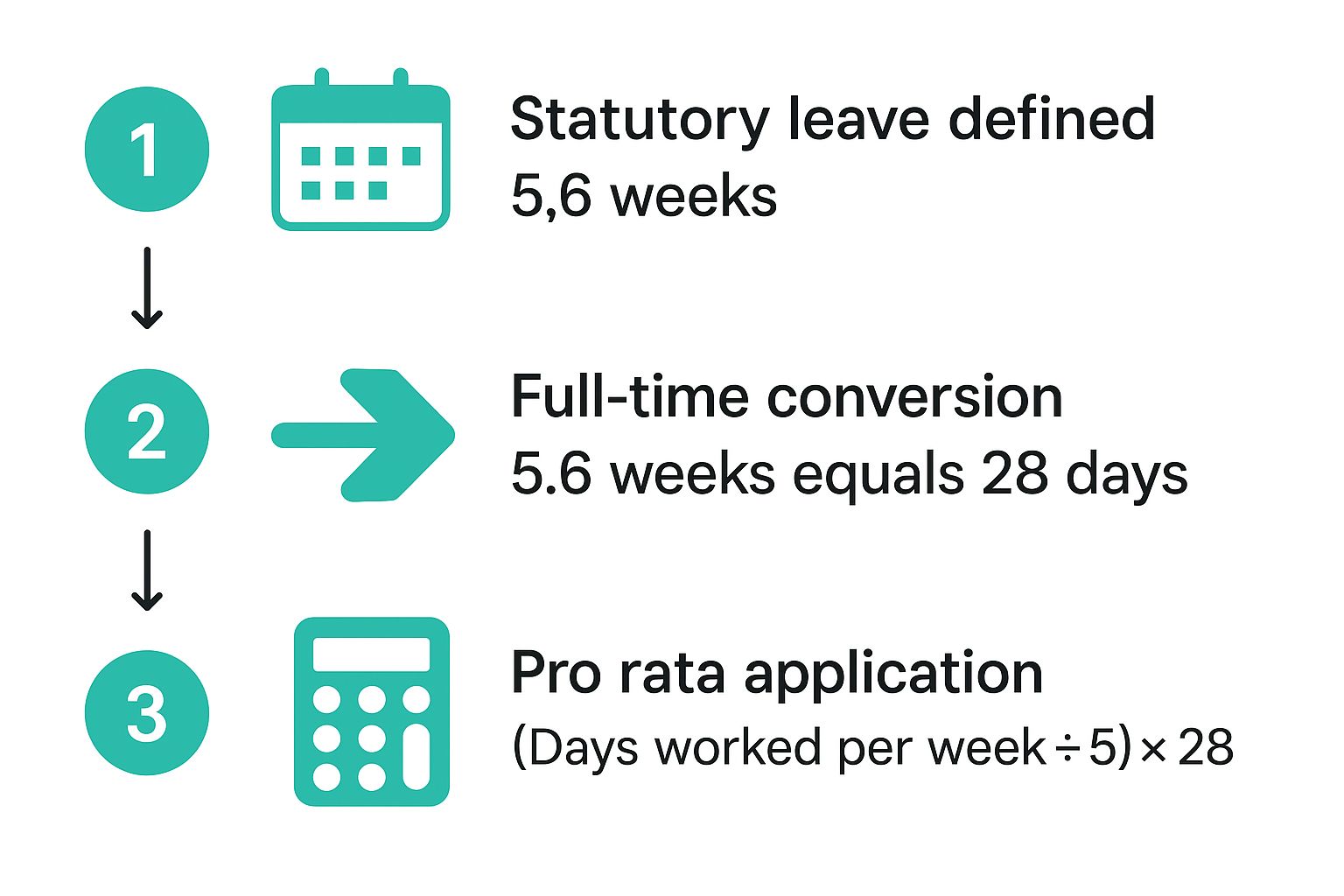

The Statutory Minimum Explained

The starting point for all holiday calculations is the statutory minimum entitlement. In the UK, this is 5.6 weeks of paid annual leave per year. For a full-timer working five days a week, this works out as 28 days (5.6 weeks x 5 days).

This figure was set by the Working Time Regulations 1998 and applies to nearly all workers, even those on irregular or agency contracts. For part-time staff, you simply calculate this on a pro rata basis. For instance, if someone works three days a week, their leave is (3 ÷ 5) × 28 days = 16.8 days. Remember, you can always offer more generous holiday terms, but you must never round their entitlement down. For the official line, you can find more on holiday entitlement rights from GOV.UK.

This infographic gives a great visual breakdown of how the calculation works in practice.

As you can see, the core idea is to convert the statutory 5.6 weeks into a figure that reflects an employee's specific work schedule.

The key takeaway is that fairness is built into the system. Every worker, regardless of their contract type, is entitled to the same rate of holiday accrual—it’s just scaled to their working hours.

This proportional system gives everyone much-needed clarity and protects both you and your employees. Before we jump into the specific formulas, it's really important to grasp this foundational 'why'. If you want a wider look at the topic, take a look at our guide on how to calculate annual leave entitlement.

The Core Formulas for Calculating Pro Rata Holiday

Now that we've covered the 'why', it's time to get our hands dirty with the actual calculations. The good news is, for most typical work patterns, you only need a couple of straightforward formulas.

Let's break down the two main methods you'll use time and again: one for employees who work set days and another for those whose contracts are based on hours. These formulas are your key to translating the statutory 5.6 weeks of holiday into a figure that’s fair and accurate for any part-time schedule.

Calculating for Employees on Fixed Days

This is probably the scenario you'll encounter most often. Think of part-time staff who have a consistent weekly schedule—maybe they work every Monday, Tuesday, and Wednesday. The calculation is simple because it directly compares their working week to a standard five-day week.

Here’s the formula you’ll need:

(Days worked per week ÷ 5) × 28 = Annual Holiday Entitlement in Days

Let's see how this works in practice.

Imagine you've just hired a new marketing assistant, Sarah, who will be working three days a week. To figure out her statutory holiday entitlement, you'd calculate:

- (3 ÷ 5) × 28 = 16.8 days

Under UK law, you can't round holiday entitlement down, so you must give at least 16.8 days. Many employers find it easier and better for morale to round up to the nearest half or full day. So, in this case, Sarah would be entitled to 17 days of paid holiday per year. It's a common and clear approach that avoids any confusion.

To help you with this, here are some common calculations already worked out.

Pro Rata Holiday Calculation Based on Days Worked

This table gives you a quick reference for calculating the statutory 28 days pro rata entitlement for employees working a fixed number of part-time days each week.

| Days Worked Per Week | Calculation | Annual Holiday Entitlement (Days) |

|---|---|---|

| 1 | (1 ÷ 5) × 28 = 5.6 days | 5.6 days (often rounded up to 6) |

| 2 | (2 ÷ 5) × 28 = 11.2 days | 11.2 days (often rounded up to 11.5) |

| 3 | (3 ÷ 5) × 28 = 16.8 days | 16.8 days (often rounded up to 17) |

| 4 | (4 ÷ 5) × 28 = 22.4 days | 22.4 days (often rounded up to 22.5) |

As you can see, the maths is simple, but always remember that rounding down is not an option.

Calculating for Employees Working in Hours

But what about team members whose contracts are defined by hours, not days? This is common for retail staff contracted for 25 hours a week or a support agent working a specific number of hours. In these situations, calculating their leave in hours is far more accurate and avoids a lot of headaches.

First, you need to work out what the full-time statutory entitlement is in hours. This depends on what you define as a standard full-time week. If we assume a typical 37.5-hour week (5 days at 7.5 hours each), the calculation is:

28 days × 7.5 hours/day = 210 hours

With that number, you can use this formula for your hourly staff:

(Hours worked per week ÷ Full-time hours per week) × Full-time holiday in hours = Annual Holiday Entitlement in Hours

Let's take another real-world example.

Say you have a customer service representative, David, who works 20 hours per week. Your company's standard full-time week is 37.5 hours, which we've established gives a full-time holiday allowance of 210 hours.

David's calculation would be:

- (20 ÷ 37.5) × 210 = 112 hours

Simple as that. David is entitled to 112 hours of paid holiday for the year.

Calculating in hours is a lifesaver when an employee's working days are different lengths—for instance, if they work a long day on Monday and a short day on Friday. It provides a precise and fair measure of their leave, no matter what their daily schedule looks like.

Mastering these two core formulas will put you in a great position to handle the vast majority of your pro rata holiday calculations, ensuring you’re managing leave fairly and correctly across the entire team.

Figuring Out Holiday Pay for Irregular and Zero-Hour Staff

This is where things can feel a bit tricky. How do you possibly work out a fair holiday allowance for staff whose hours change every week, or for those on casual and zero-hour contracts?

The standard formulas based on fixed days just won't cut it. The solution is actually quite straightforward: calculate holiday entitlement as it's accrued based on the hours they actually work.

This approach ensures an employee’s holiday entitlement is always directly proportional to the time they’ve put in, no matter how much their schedule fluctuates. It’s a fair and transparent system that works perfectly for modern, flexible working arrangements.

The 12.07% Accrual Method

If you've looked into this before, you've probably seen the figure 12.07% pop up. This isn't just a random number; it comes directly from the statutory holiday rules in the UK.

Here's the breakdown of how it's calculated:

- A standard year has 52 weeks.

- The statutory paid holiday entitlement is 5.6 weeks.

- This leaves 46.4 working weeks in the year (52 weeks - 5.6 weeks = 46.4).

- To get the percentage, you simply divide the holiday weeks by the working weeks: (5.6 ÷ 46.4) × 100 = 12.07%.

This method has become the gold standard for calculating pro rata leave for staff with irregular hours. It means that for every hour someone works, they earn holiday time at a rate of 12.07%.

Putting It into Practice

Let's take a real-world example. Imagine you have a casual worker, Tom, who helps out with events. His hours are all over the place. Last month, he worked a total of 80 hours.

To figure out the holiday he earned in that month, you just apply the percentage:

80 hours × 12.07% = 9.656 hours

So, from his work last month, Tom has earned just over 9.6 hours of paid holiday. You just repeat this calculation for each pay period, and his holiday pot grows in line with the hours he logs. It completely removes the guesswork.

This percentage-based system is the most reliable way to handle holiday entitlement for your most flexible workers. It guarantees you remain compliant while providing a transparent and easy-to-understand calculation for your team.

This system is perfect for:

- Agency workers

- Casual staff

- Employees on zero-hour contracts

- Anyone whose hours aren't fixed from one week to the next

It’s a simple piece of maths that solves a complex problem. If you manage people on these types of contracts, I'd highly recommend reading our deep-dive on understanding holiday entitlement on a zero-hour contract. Adopting this method will give you real peace of mind that you're getting it right for everyone.

Managing Holiday for Starters, Leavers, and Bank Holidays

It’s a common misconception that pro rata calculations are only for part-time staff. In reality, you'll be using them all the time to fairly manage leave when people join or leave your company mid-way through the holiday year.

Getting these calculations right is crucial for staying compliant and treating everyone equitably. And then there are bank holidays, which often add another layer of complexity, especially for part-timers. Let’s break down how to handle these everyday situations with confidence.

Calculating Holiday for New Starters

When someone new joins the team, they start earning their holiday entitlement from day one. Their allowance for that first year needs to be worked out proportionally, from their start date right up to the end of your company's holiday year.

The most straightforward approach is to figure out the fraction of the year they’ll be with you. A good rule of thumb is that an employee accrues 1/12th of their annual leave for each full month they work.

Let's look at a real-world scenario:

Imagine your holiday year runs from January to December. A new full-time employee, who gets 28 days a year, starts on 1st April.

- They will work 9 months of the year (April through to December).

- The calculation is simple: (9 months ÷ 12 months) × 28 days = 21 days.

- So, your new starter is entitled to 21 days of paid holiday for the rest of that year.

This same logic applies if your new starter is part-time. You just start the calculation with their pro rata annual figure instead of the full-time one.

Handling Holiday for Leavers

When an employee leaves, the process is essentially the same, just in reverse. You need to calculate the holiday they’ve accrued up to their final day to make sure they've received the correct amount for the time they’ve worked.

If they’ve taken less holiday than they’ve earned, you’ll need to pay them for those outstanding days in their final payslip. On the flip side, if they’ve taken more holiday than they were entitled to, you may be able to deduct this from their final pay—but only if this is clearly stipulated in their employment contract.

Nailing this down is a critical part of understanding how to calculate holiday pay in the UK, as a solid contract clause protects both the business and the departing employee.

The Bank Holiday Puzzle for Part-Time Staff

Bank holidays can be a real headache. One of the most frequent mistakes I see is businesses assuming that if a bank holiday falls on a part-timer's non-working day, they just miss out. This is not only incorrect but can also lead to claims of unfair treatment.

Part-time employees are entitled to a pro rata share of paid bank holidays, just like the rest of their annual leave.

The best way to ensure fairness is to give part-time staff a total pro rata holiday allowance that already includes bank holidays. They then book any bank holidays that fall on their normal working days out of this total pot. This system ensures everyone gets their fair share, no matter which days of the week they work.

For instance, if a part-timer works Monday to Wednesday and their total pro rata entitlement is 16.8 days, they would use one day from that allowance for the May Day bank holiday. A colleague who doesn't work Mondays isn't left out, because their overall entitlement is calculated in exactly the same fair way.

Common Pro Rata Calculation Pitfalls to Avoid

Even with the best intentions, it's surprisingly easy to make a small error when calculating pro rata holiday. These simple mistakes can quickly lead to unhappy team members, compliance headaches, and even legal disputes down the line. Think of this section as your pre-flight check to make sure your sums are fair, accurate, and watertight.

Getting the maths right is only half the battle. Knowing the common traps and how to sidestep them is just as important, and I've seen many businesses stumble over the same few issues time and time again.

Rounding Rules and Fractional Days

Here's one of the most critical rules, and it’s non-negotiable: you must never round an employee's holiday entitlement down. It’s illegal. If your calculation spits out a fraction, say 16.8 days for someone working three days a week, they are entitled to at least that amount. Rounding it down to 16 days is simply not an option.

Now, you aren't legally required to round up (with the slight exception of a new starter’s first year, where part days must be rounded up to the nearest half day). However, most employers I know choose to round up to the nearest half or full day. It’s simpler for everyone and a great gesture of goodwill. That 16.8 days becomes a clean 17 days.

This principle also covers 'part days'. An employee has the right to take that fractional leave, perhaps by arranging a late start or an early finish. You can find more practical guidance on this over on the ACAS website, which really is the go-to resource for handling these scenarios fairly.

Remember: The law is designed to prevent employees from being disadvantaged. Always work with the exact fraction or round up—never, ever down.

Mishandling Bank Holidays for Part-Time Staff

Another major pitfall is getting bank holidays wrong for part-timers. There's a persistent myth that if a bank holiday falls on a part-timer's non-working day, they just miss out. This isn't just unfair; it can be discriminatory.

A part-time worker is entitled to a pro rata share of paid bank holidays, just like any other part of their annual leave. The fairest and simplest way to manage this is to:

- Calculate their total pro rata entitlement for the year, making sure you include all bank holidays in the initial pot.

- Then, when a bank holiday falls on one of their normal working days, they book it off from that total allowance.

This approach ensures the person who never works on a Monday isn't unfairly penalised compared to colleagues who do. It levels the playing field completely.

Miscalculating Holiday Pay Rates

Finally, a crucial and costly mistake is calculating holiday pay based only on an employee's basic salary. This is a common one. Holiday pay must reflect what an employee would have normally earned had they been at work.

That means you need to factor in other regular payments. Your calculations should include things like:

- Regularly worked overtime, whether it's compulsory or voluntary.

- Commission payments that form a consistent part of their earnings.

- Performance-related bonuses.

Forgetting to include these components means you're underpaying your staff for their time off. To get it right, always look back at an employee's recent pay history to calculate an accurate average rate for their holiday pay.

Pro Rata Holiday FAQs

Even when you've got the formulas down, real-world situations can throw a spanner in the works. Calculating pro rata holiday isn't always straightforward, especially when an employee's circumstances shift part-way through the year.

Let’s tackle some of the most common questions I hear from business owners and HR managers. These are the tricky scenarios that often need a closer look to make sure you're being fair, compliant, and supportive of your team.

What Happens When an Employee Changes Their Hours Mid-Year?

This one comes up all the time. Someone might switch from full-time to part-time after returning from parental leave, or maybe they get a promotion that increases their contracted hours. When this happens, their holiday entitlement needs a recalculation.

The best and fairest way to handle this is to break the holiday year into two distinct periods.

- First, calculate their entitlement for the time they spent on their old working pattern.

- Then, calculate their entitlement for the rest of the year based on their new working pattern.

Once you have those two figures, just add them together. This two-part calculation gives you a total entitlement that accurately reflects the hours they've actually committed to throughout the year.

How Does Sick Leave or Family Leave Affect Holiday Accrual?

This is a really important one from a legal standpoint. Employees continue to accrue their statutory holiday entitlement as normal while they are on any form of statutory leave. This covers everything from sick leave and maternity leave to paternity, adoption, and shared parental leave.

Simply put, team members on extended leave must not be penalised. They earn holiday at the exact same rate as if they were in the office, so their pro rata calculation doesn't change during their absence.

It's always best to encourage employees to use their holiday within the current leave year. But, if their absence makes that impossible, you are legally required to let them carry it over to the next one.

Do I Include Regular Overtime in Holiday Pay Calculations?

Yes, you absolutely must. This is probably one of the most frequently misunderstood parts of holiday pay. The core principle is that holiday pay should reflect what an employee would have normally earned if they were at work.

If someone consistently works overtime, whether it's compulsory or regular voluntary hours, that extra pay has to be factored into their holiday pay rate. The goal is to prevent them from facing a financial penalty for taking time off.

To get this right, you need to look back and calculate their average weekly pay over a 52-week reference period (using only the weeks in which they were paid). This average becomes the basis for their weekly holiday pay, ensuring it's a fair reflection of their typical earnings.

Trying to manage all these nuances with a spreadsheet is a recipe for headaches and potential mistakes. A tool like Annual Leave Tracker can handle everything from mid-year contract changes to complex accrual rules automatically, making sure your calculations are always spot on and compliant. You can see how it works over at https://www.annualleavetracker.com.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.